MoneyTalk #4: SIP for 25 Years, SWP for 25? Here’s Why This Strategy Could Fail You!

- kkgala

- Nov 16, 2024

- 8 min read

Updated: Nov 21, 2024

Question: An influencer made a reel showing how one can invest Rs. 100,000 today (one time) in an Index Fund, hold it for 25 years, at 14% annual return, he can withdraw Rs. 100,000 every year thereafter for next 25 years and still be left with Rs. 50,00,000 of corpus. Is it true? Does this work? Shall I do it too?

You’ve probably seen the enticing claims from financial influencers: invest in a SIP (Systematic Investment Plan) for 20-25 years, and then enjoy a comfortable, stress-free retirement by withdrawing regular amounts through an SWP (Systematic Withdrawal Plan) in your retirement years.

The idea commonly propagated is as follows:

Invest ₹10,000 monthly via SIP in a mutual fund for 15 years.

Assume an annualized return of 12%.

Accumulate a corpus of around ₹50 lakh.

Transition to an SWP, withdrawing ₹20,000 monthly over the next 30 years.

Sounds easy, right? But what if we told you this strategy is built on shaky assumptions and could lead to your retirement funds running out far sooner than expected?

Welcome to the hidden world of Sequence of Returns Risk, a critical factor that these influencers conveniently ignore.

In this blog, we’ll pull back the curtain on why relying on “average returns” is a recipe for financial disaster and reveal how real-world market volatility can make or break your retirement dreams. If you’re serious about securing your future, you cannot afford to miss this!

What is Sequence of Returns Risk?

Imagine this: you followed advise of the influencer and invested ₹20,000 monthly in a mutual fund via SIP for 15 years. At an assumed 12% annual return, your corpus grows to ₹1 crore. Then, you start withdrawing ₹50,000 monthly through SWP, expecting it to last 30 years, all while earning “average returns.”

It’s a dream many influencers sell as foolproof.

But here’s the problem: markets don’t move in a straight line. Returns fluctuate yearly, and the sequence in which they occur can drastically affect your outcomes. Markets are inherently volatile. Over the last few decades, the Nifty index has seen years of both stellar growth and sharp declines. Yet, financial influencers often oversimplify this complexity by using average returns in their illustrations.

For instance, a 12% average return doesn’t mean your portfolio grows by 12% every year. If you encounter negative returns early in retirement, your withdrawals can deplete your corpus faster than expected. This phenomenon is known as Sequence of Returns Risk.

To understand sequence of returns, let’s first clarify the term itself. Sequence of returns refers to the order in which you experience your investment returns during your accumulation phase (SIP phase) and your decumulation phase (SWP phase). While many financial models focus on the average return over a period of time, they often fail to account for the fact that the timing of returns plays a huge role in how your investments grow or deplete.

For example, let’s say two investors – Jay and Parth invest Rs. 100,000 and earn the same average return of 12% annually over a 25-year period. Jay might experience series of fluctuating returns of 20%, -5%, 15%, etc., during his investment journey, while the Parth earns a series of steady returns, such as 12%, 12%, 12%, etc.

The sequence in which Jay earns return will have an impact on his investment corpus as well as during his withdrawal phase. His investment corpus and withdrawal years can be drastically different than Parth. (read below to see the impact on his accumulation and withdrawal phase)

What Financial Influencers Miss? - The Myth of Average Returns

Many financial influencers and content creators suggest that if you simply invest in an SIP for a set number of years (say 10-15 years) and then transition to an SWP, you’ll be able to generate steady, predictable returns over a long period (e.g., 30 years). This advice typically ignores sequence of returns risk, as it assumes that the average return will remain constant throughout the investment period.

Sequence of Returns Risk refers to the timing and order of market returns, especially during the withdrawal phase affects your portfolio. Negative returns early in retirement can erode your portfolio faster than positive returns later can replenish it. For example, starting SWP in a year like 2008, when markets crashed, could drain your portfolio significantly, even if the market recovers later.

Influencers rarely address this risk because averages are easier to sell—but averages don’t reflect real-world risks.

Real-Life Impact of Sequence of Returns

The real danger comes when the market experiences significant downturns early in the accumulation phase, or during the decumulation phase (i.e., when you're withdrawing funds). If this happens, the value of your portfolio could be substantially reduced, and it may not have enough time to recover before withdrawals start.

This phenomenon is particularly concerning in scenarios where investors plan to live off their investments for 30+ years. A negative sequence of returns in the early stages of your retirement (when you’re withdrawing via SWP) can cause your portfolio to deplete much faster than you expected. On the other hand, positive returns early on can give you more flexibility and a higher likelihood of sustaining your withdrawals.

Why Does Sequence of Returns Matter for SIP and SWP?

To understand the impact, let’s take an example to illustrate why relying on average returns and constant withdrawal can be deceiving:

Parth invests ₹100,000 and earns an average return of 12% annually for 25 years. He then transitions to an SWP, withdrawing ₹100,000 annually for the next 25 years.

Jay also starts with ₹100,000 and earns the same average return of 12% annually over 25 years. However, during this period, the returns fluctuate significantly, with the first 5 years delivering a return of 10%, -9%, 29%, 21%, and -21%, and so on. He then transitions to the same SWP strategy for 25 years.

SIP Period (Investment/Accumulation Period)

When you’re investing through an SIP, you are accumulating wealth over time by making regular contributions, often without withdrawing from the investment. The early years are critical for the success of this strategy, as positive returns during these years can compound and boost your portfolio. However, if negative returns occur early on (especially when the markets are volatile), the impact can be significant, even if the long-term average return remains healthy.

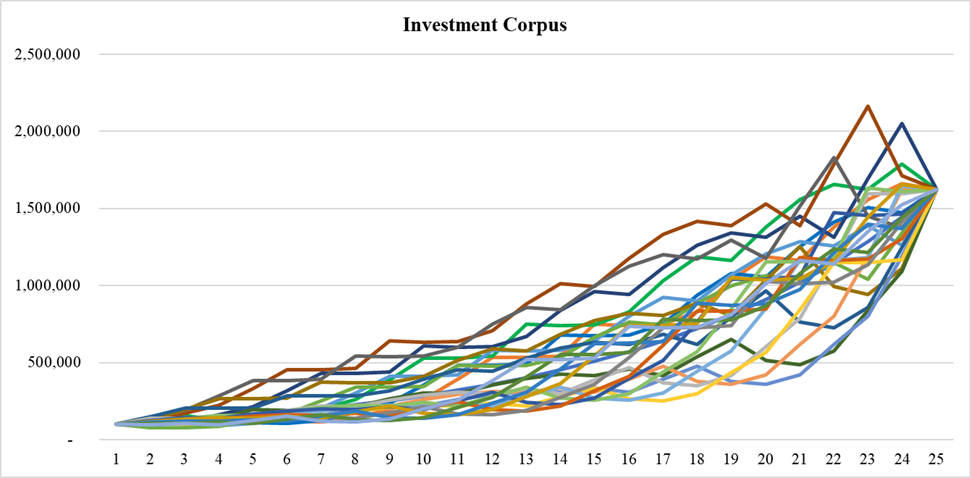

Here, both Jay and Parth manage to accumulate same corpus of Rs. 16,00,000 after 25 years. However, Parth sees a linear growth whereas Jay’s portfolio saw many ups and downs during these 25 years of accumulation.

Now, what happens when we change sequence of returns earned for Jay?

a) Jay’s portfolio went below investment value on multiple instances when Parth’s portfolio was showing a gain of 40%. (This would have tested his patience and behavior.)

b) Jay’s portfolio managed to touch Rs. 20,00,000 before falling back to Rs. 16,00,000. (Active portfolio manager/advisor would have suggested him to switch from Equity to Debt during phases of earning more than average return.)

c) Jay’s portfolio was underperforming in 276 scenarios out of 576. During sequence of lower than average initial period returns, Jay’s portfolio has underperformed throughout 25 years of accumulation phase.

SWP Period (Retirement/Withdrawal Period)

Now, let’s consider the SWP phase. This is the phase where you start withdrawing funds from your investment, often to meet living expenses or for retirement income. If you start withdrawing during a market downturn — particularly in the early years — the sequence of returns can cause your portfolio to deplete much faster than you anticipate. This is because you’re selling investments at lower values, which means your portfolio may not have enough time to recover.

During SWP phase, we have assumed corpus created during accumulation phase of Rs. 16,00,000 and annual withdrawal of Rs. 100,000 adjusted for 7% inflation rate annually. Also, sequence of return is same as during accumulation phase i.e. both portfolio’s earn average return of 12%.

Despite both investors having an average annual return of 12%, the difference in sequence of returns leads to dramatically different outcomes. Parth, who enjoyed consistent positive returns over time, will likely have a much larger corpus to withdraw from during the SWP phase. On the other hand, Jay, who experienced significant volatility in the early years, will find their portfolio depleting faster due to the negative sequence of returns in the beginning.

(While the influencer was right on paper, i.e. corpus of Parth (earning average return of 12%) grows to Rs. 50,00,000 even after regular withdrawals. However, Jay’s corpus (which shows actual volatile return of NIFTY) is down to Rs. 50,000 at end of 25th year.)

Wondering how does Jay's corpus look like in different scenarios during SWP phase?

a) In 19 out of 24 scenarios, corpus at end of 25 years was less than Rs. 50,00,000 as claimed by the Influencer who ignored sequence of returns. (Only in 10 scenarios, corpus lasted till end of 25th year)

b) In a scenario, where market returns were negative in initial years and withdrawals continued, portfolio lasted only for 16 years, and not 25 years. (Imagine you retire at 50 with a planned corpus assumed to last till you turn 75, got depleted when you are 66 years old! What does one do in such a situation?)

c) When market returns during initial years were above average, corpus at end of 25th year was more than Rs. 1 crore even after regular withdrawals!

How to Mitigate Sequence of Returns Risk

There’s no one-size-fits-all solution, but you can reduce the impact of sequence risk with these strategies:

Diversification: Spread your investments across equity, debt, gold, real estate and alternative assets to reduce volatility and to smoothen returns. Hybrid funds or balanced advantage funds adjust equity and debt exposure based on market conditions, reducing volatility.

Dynamic Withdrawals: Adjust your SWP amount based on market performance. Withdraw less during downturns and more during bull runs. Instead of fixed withdrawals, align your SWP amount with portfolio performance. Withdraw less in bad years to preserve capital.

Portfolio Reviews: Regularly rebalance your portfolio to maintain your desired risk level. Ensure that your investment strategy is aligned with your goals, risk tolerance, and time horizon. Regularly review your portfolio to ensure it remains on track.

Emergency Fund: Keep a cash buffer to cover withdrawals during market dips without touching investments. Allocate 2-3 years’ worth of expenses in low-risk instruments like liquid funds or fixed deposits to avoid withdrawing from equity portfolios during downturns.

Retirement Planning: Work with a financial advisor to build a retirement plan that takes into account not just average returns, but also sequence of returns risk. A well-structured plan can help ensure that you don’t outlive your assets.

Final Thoughts: Rethinking SIP and SWP for Retirement

Key Takeaways for Investors

Don’t be swayed by overly simplistic illustrations of SIP + SWP strategies.

Sequence of returns risk can derail retirement plans if not accounted for.

Work with a financial advisor to stress-test your retirement strategy.

The promise of building wealth through SIPs and sustaining it with SWPs sounds compelling—until you confront the reality of Sequence of Returns Risk. Markets are unpredictable, and relying on average returns oversimplifies a complex problem that could jeopardize your retirement. The truth is, financial planning isn’t about magic numbers or cookie-cutter strategies; it’s about accounting for risks, including the sequence in which returns occur.

Now that you know the dangers of ignoring this critical factor, it’s time to rethink your retirement strategy. Is your current plan built to withstand market volatility? Are you taking the right steps to ensure your hard-earned money lasts as long as you need it?

The SIP-to-SWP strategy isn’t inherently flawed, but it needs to be tailored to individual goals and risks. Blindly following generic advice can jeopardize your financial future. Instead of relying on average returns and influencer claims, focus on personalized financial planning that accounts for market realities like sequence risk.

Your retirement deserves more than averages—it deserves a plan.

Disclaimer: The views expressed in this blog are for informational purposes only and do not constitute financial advice. Please consult a certified financial planner or a SEBI registered advisor for personalized recommendations.

Comments