MoneyTalk #1 - Should I follow FinFluencers to earn higher returns?

- kkgala

- May 18, 2024

- 4 min read

Question: A FinFluencer recommended an investment strategy to earn higher returns than market. He suggested not to invest in Mutual Fund and invest in ETFs. The plan also included to not follow monthly SIP but rather buy ETF when market closes in red. Will this strategy help in earning higher returns? If it works then why should I invest in active funds?

FinFluencers in the market are available a dime a dozen. Each one of them is luring investors with investment strategies and recommendations which may not always help investors. One of our clients watched one such video and came to us with questions. We have attempted to answer this question with detailed analysis through this post for benefit of all our readers.

We will break it down in three segments....

a) What is Mutual Fund (MF) and ETF?

MFs are managed by professional fund managers who make investment decisions on behalf of investors. Mutual Funds can be both Active and Passive. In an Active Fund, fund managers aim to outperform market indices by leveraging their expertise and market insights. Passive fund tracks specific index offering returns that mirror index. Passive Funds have lower expense ratios compared to Active Funds.

ETFs are bought and sold on stock exchanges, just like individual stocks. Most ETFs track a specific index, offering returns that mirror the performance of that index. They often have lower expense ratios compared to Passive Funds. ETFs can be traded during market hours at market prices, offering more flexibility to investors.

ETF price is updated real time whereas MF declares Net Asset Value (NAV) on daily basis and trades are made at declared NAV.

ETFs are better than Index Funds as suggested by the Finfluencer.

b) Should I buy ETF on fixed date every month or buy the dip i.e. buy only when market is in red?

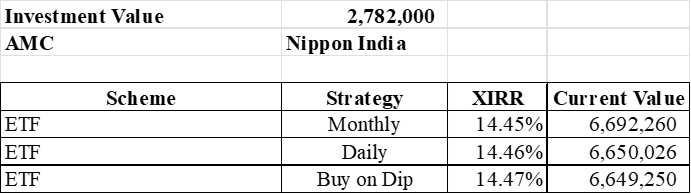

To check if this strategy generates superior returns, we back tested data of NiftyBees (ETF) data since 01-01-2013. (Only 3% investors continue to invest for more than 5 years, so back-testing period of 10+ years is significant time period. NiftyBees was a random selection, & not a buy recommendation).

We tested returns under three buckets -

i) Monthly SIP - We buy on 1st of every month.

ii) Daily SIP - We invest Rs. 1,000 on daily basis at average price during the day.

iii) Buy the Dip - We invest only when market closes in red at end of the day price. If market closes in green, we accumulate amount and invest total on day when market closes in red. (E.g. If market closes in red then we invest Rs. 1,000 on same day. If market closes in green for continuous 2 days and closes in red on the 3rd day, we invest Rs. 3,000 on that day.)

There is no significant difference in returns under any strategy. Investor is indifferent across strategies. FinFluencer strategy suggesting to buy the dip to generate superior returns is not very helpful.

c) Whether I should invest in ETF, Passive Fund or an Active Fund?

We have already explained difference between ETF and Mutual Funds. In terms of risk, all three of them invest in equity and have a similar risk profile. So difference will be in returns.

Difference in ETF and Index Fund XIRR is due to lower Expense Ratio and Tracking Error. ETF generates 5% more value compared to Passive Fund. Though difference is not very significant considering it was generated over 10 years.

Investing via Passive Fund helps in habit building through SIPs, whereas purchasing ETF has to be done manually. Investor may sometimes forget to purchase. Also, inertia may kick in while placing purchase order. (Many new age brokers are now offering SIPs in ETF and Stocks as well. However, investor will have to maintain sufficient balance in trading account.)

Active Funds can significantly outperform Passive Funds and ETFs. Fund Managers try to maximize returns through active fund management. Fund managers can make strategic adjustments to the portfolio, such as shifting assets to defensive sectors or increasing cash holdings to protect against losses. ETFs, being passive, do not offer this flexibility.

Conclusion:

Active Funds > ETFs

ETFs > Passive Funds

Daily SIP = Monthly SIP = Buy the Dip

While ETFs offer lower costs and flexibility, active mutual funds provide the potential for higher returns through active management and tailored strategies. However, there are 2,000+ active funds and not all investors know how to select mutual funds, ETFs would be better investment choice for such investors. (PS: you have 50% chance of selecting an active large cap fund that outperforms index over 10 year period)

Disclaimer: Mutual Funds and ETFs mentioned in this post are for illustration purpose only. It is not a buy/sell recommendation. Purpose of this post was to highlight difference between ETFs, Active and Passive Mutual Funds. While we have randomly selected NiftyBees (ETF). Index Fund and Large Cap Fund were selected from the same AMC to maintain consistency. Returns may be different for different selection of ETF and Mutual Funds. We do not claim accuracy of returns. Calculations may be prone to errors. XIRR illustrated in this post is past returns and should not be construed as claim to future returns or guaranteed returns. Consult your financial advisor before making any investment decision.

Comments